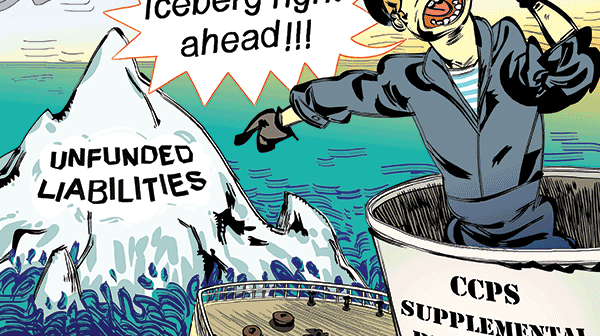

Unfunded liabilities in a supplemental retirement plan for Chesterfield County Public Schools’ employees accumulated to nearly $100 million over more than two decades, according to a report recently issued by the county’s internal audit director Greg Akers.

Akers, who presented his report to the county’s Audit and Finance Committee on March 12, said trustee investment services and the retirement plan were not actively managed from 1995 to 2017. A chart in the report shows that net pension liability was at $99 million in early 2016. By mid-2017, the figure had declined to just over $80 million.

Akers said the Chesterfield County Public Schools Board approved plan changes – most of which were minor technical adjustments – without approval of the Board of Supervisors from 1997 to 2017. However, a major change approved by the board closed the plan to new participants after June 30, 2013. As of June 30, 2016, some 5,611 people were enrolled in the plan.

Fiduciary oversight of the plan was minimal prior to a plan revision in 2017, the report said. In addition, Akers did not find documentation of competitive procurement for trustee services. The report refers to Suntrust Bank as the service provider, serving the plan since 2002. Trustee fees for Fiscal Year 2017 were $85,000, according to the report.

The school district hired the Sands Anderson law firm to provide legal advice regarding the plan, and communications between the company and the school district were not provided to Akers. “Had we had access, our reported results and findings may have been different,” he said.

Akers said the audit was done at the request of the school board and Superintendent James F. Lane. Akers also noted that school district management concurred with his 14 recommendations, which will be implemented from March 1 to July 1.

Among his recommendations were: designate a school operational lead for the plan, formalize operating practices into written procedures and record fund activity in accounting records throughout the year.

Christina Berta, the schools’ chief financial officer, will be the operational lead.

“The School Board made significant changes last year to bolster the long-term sustainability of a program that is an important employee retention tool,” School Board

Chairman John Erbach said in an email. “The auditor’s findings were not unexpected given the changes that were necessary. However, we are confident that the steps we have taken have helped make the plan solvent.”