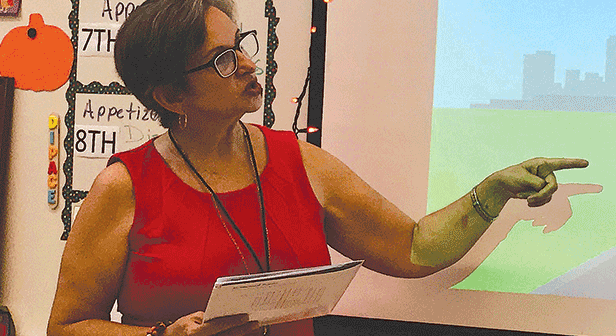

ABOVE: Gracia DiPace, a teacher at Salem Church Middle School, shows students how to use a Banzai financial tool; Chesterfield Credit Union’s Chris Miller

In an effort to encourage financial literacy and responsibility, some Chesterfield County schools have implemented a program to teach students how to manage their money.

Banzai, a financial literacy program for students, exposes them to real-life adult financial dilemmas, from taming a budget and paying auto insurance to navigating taxes.

The program uses lifelike simulations, which help students learn how to make hard decisions, protect their credit and even go through the home-buying process.

The premium software is free of charge for 45 community schools thanks to the sponsorship of Chesterfield Federal Credit Union.

Chris Miller, vice president of communications and branding, said the credit union always had an interest in financial literacy and supporting Chesterfield public schools.

“We were certainly in the market for … a financial education solution,” he said. “So when we reviewed the Banzai program, it fit our needs to provide free resources to the teachers so we can be in the classroom without actually having to be in every classroom.”

The credit union has been sponsoring the Banzai program for four years, and Miller has been a guest speaker in the classroom because some teachers like having a third party come in and say a few words.

“I’ve had some amazing classes,” he said. “I leave the class feeling great because I feel that we’ve made a difference and they all learned something. Usually I learn something too, just about what people are thinking, how they get from point A to point B, how they understand things. I think that’s one of my favorite parts of my job.”

Eighth-grade experience

Gracia Lou DiPace teaches Family and Consumer Sciences at Salem Church Middle School and has been teaching the Banzai program to eighth-graders for six years.

After receiving an email about Banzai and being introduced to it at the state conference for Family and Consumer Sciences, DiPace ordered the booklets for her students and used them for four years until the program switched to a completely online presence last year.

DiPace said she loves the program because most of her students are not otherwise exposed to financial awareness.

“The Banzai program … gives them the responsibility for figuring out how they’re going to utilize their budget.” The program’s scenarios “are a way for them to experience going through each of those things,” she said.

DiPace introduces her class to the program early in the school year because she wants to know what their knowledge base is. Once they learn about the program and use the online simulations, her students will then take a post-test that counts toward their nine-week grades.

“I don’t do a whole lot besides the Banzai because … it’s very encompassing, very inclusive,” she said. “It really does give them kind of a general overview of all the basic terms and skills – even the difference between paying for rent compared to a mortgage.”

All high school students are required to take a financial literacy course. DiPace said the Banzai program gives them a good basis before they take the class.

Miller thinks it’s great for students to have a head start in understanding what it means to be financially literate. He said being more aware will improve things for everybody.

The credit union offers an annual scholarship for its members. He said several recipients have mentioned how appreciative they were of someone coming in, taking interest in them and making sure they understood the importance of finances.

“It’s just really great to see that enhanced understanding,” Miller said. “Certainly there’s more that we can do, but it’s great to see forward movement in students graduating with a better understanding of their finances and why it’s important.”